Best Practices for Cannabis Companies

Best Practices for Cannabis Companies

Close in as little as 7 days.

Over 53 years of lending success.

Solutions for all situations.

COLORADO IS LIVING IN A “CANNABUBBLE” because it was the first state to legalize recreational cannabis sales, a decision that has put it in the spotlight for other states considering similar measures. And how Colorado’s cannabis industry matures continues to generate debate at the national level among Washington D.C. legislators, according to Saphira Galoob.

COLORADO IS LIVING IN A “CANNABUBBLE” because it was the first state to legalize recreational cannabis sales, a decision that has put it in the spotlight for other states considering similar measures. And how Colorado’s cannabis industry matures continues to generate debate at the national level among Washington D.C. legislators, according to Saphira Galoob.

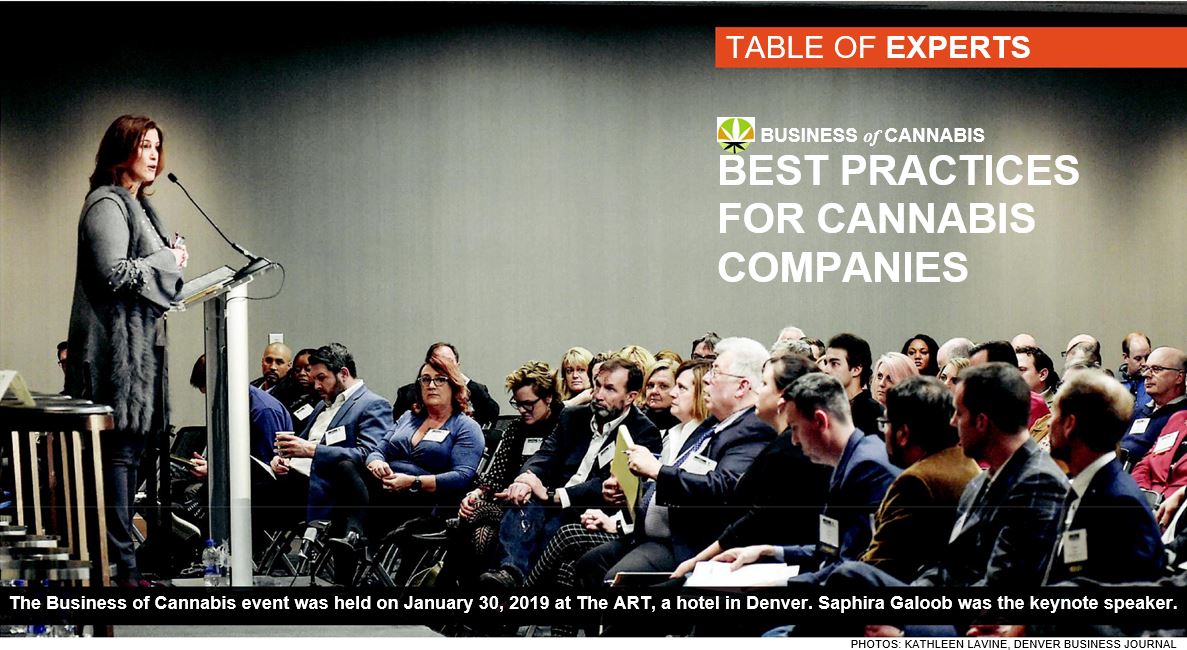

The politics, policies and personalities of cannabis in the nation’s capital is an evolving landscape, according to Galoob, who gave the keynote address at the Denver Business Journal’s “Business of Cannabis” event in Denver this month. Colorado and Washington voters approved legalization in 2012 but the Centennial State stepped into the forefront of the cannabis industry and continues to be the model to which other states study.

Classifying those who changed Colorado’s laws permitting recreational sales as “legacy advocates and legacy fighters,” Galoob said conversations about cannabis are different today compared to five years ago. “D.C. and the cannabis policy discussion over the past few years has changed drastically,” said Galoob, principal and CEO of The Liaison Group, Washington D.C.’s only boutique lobbying firm focused solely on the cannabis industry.

Highlights Summarizing Galoob’s remarks:

The growing momentum of cannabis conversations on Capitol Hill signal to industry investors, business owners and service providers that meaningful federal cannabis reform is on the horizon. With the inevitable direction of changes in federal cannabis policy, our industry is uniquely positioned in the driver’s seat to shape the key policy initiatives that will impact us in the near and long term. The good news is, from a cannabis policy perspective, that the House has been a really good place to be in the past three months, compared to the last Congress. Our industry has begun to settle in and welcome the change of leadership.

Despite the recent government shut down, several pieces of cannabis legislation from the 115th Congress have already been re-introduced. Industry advocates and congressional offices have been quite active. It’s been a constant push of where we were, where we are and where we’re going. We are looking to the House for viable momentum to advance many of the bills that in prior Congressional cycles died in committee. As a cannabis industry, we should expect to see about 60-plus

stand-alone authorization bills. Though while we have a Democratic caucus that may not place cannabis as their No. 1 issue, it is nevertheless an important enough issue

– and that marks key progress for industry. As advocates, we have to continue to be more nimble, more organized, more strategic and more persistent.

The U.S. Senate will require additional work to coalesce enough lawmakers who are willing to advance and support cannabis legislation. Because of the Senate rules around cloture, we will need to ensure that we have at least 60 Senators to support any legislative measure that includes cannabis reform. This means that a standalone bill or amendment to a larger bill that addresses cannabis in the the Senate will likely need to be more conservative and incremental towards ending prohibition. Despite the recent surge of activity and advocacy on Capitol Hill, as an industry, we have tremendous work ahead of us. It is going to take more than just 2019 with continued industry investment and collaboration [to move ahead.] We have to take away our personal politics and adopt a political maturity and sophistication and realize that we may not get a perfect win – but we need a win to give us a chance to continue the traction we have and drive into the future.

We are pushing for approval of legislative initiatives such as the SAFE Banking Act and the STATES Act [Strengthening the Tenth Amendment Though Entrusting States] – which would statutorily protect states with cannabis laws, solve the unfair tax treatment burdening cannabis industry businesses and ensure industry stakeholders have access to traditional banking and capital markets. There is also significant traction towards expanding medical research to demonstrate the benefits and efficacy of cannabis and veterans access to cannabis. (Note: the STATES Act would recognize legalization of cannabis in states that have legalized it through their legislatures or citizen initiates. Current federal laws are so complex that many banks and financial institutions have steered away from working with cannabis companies.)

Galoob, as an entrepreneur, strategist, business lawyer and legislative professional, with more than two decades of experience. She has successfully developed and executed campaigns to assist businesses in the navigation of the complicated – and rapidly evolving – congressional and federal agency landscape.

Those who sell cannabis products in Colorado face challenging regulatory hurdles that are vastly different from those who sell everyday retail goods. Local, state and federal laws for cannabis industry operators keep evolving, creating the need for qualified professionals to help keep businesses on track.

Colorado’s highly-successful recreational cannabis industry is in its fifth year since voters approved Amendment 64 in 2012 and the legislature followed with laws and regulations in 2014. Since then, the industry has created about 20,000 jobs while surpassing $1.4 billion in sales from January through November 2018. The state is estimated to receive $48.1 million from cannabis businesses this year, compared to $129 million in property taxes and $30 million in transportation and vehicle-related tax revenues.

When Colorado approved legislation permitting cannabis growing operations and retail recreational sales business, the entrepreneurs who launched businesses did so while always looking back over their shoulders to see what new rules – from the state or federal governments – might create difficult obstacles or potentially halt their operations.

The businesses that serve Colorado’s cannabis industry and potential legislative changes were topics at the “Business of Cannabis” forum, hosted by the Denver Business Journal. A sold-out, standing-room-only audience of more than 250 attended the Table of Experts forum this month. Panelists for the “Best Practices for Cannabis Industry Companies” discussion included:

- Robert J. Amter, president and founder of Monteg-ra Capital Resources. Montegra, a private capital money lender, provides bridge loans for real estate properties with cannabis tenants, including grow warehouses.

- Caleb R. Crandell, Tax Partner, ACM, LLP, a public accounting firm. Crandell leads ACM’s cannabis industry group and specializes in IRS examination representation, IRC Section 280E analysis, tax plan-ning and entity structuring for cannabis companies.

- Jordan Wellington, Chief Compliance Officer, Sim-plifya. The company produces regulatory compli-ance software for cannabis businesses that helps them operate within state regulations.

- Greg Winter, risk insurance and employee bene-fits consultant for Lockton, a global professional services firm that specializes in risk management, employee benefits and retirement services.

- Moderator for the panel was Rachel Gillette, partner and chair of the cannabis law practice at Greenspoon Marder, one of the first full ser-vice national law firms to establish a dedicated cannabis practice group. She was among the first attorneys in the nation to dedicate her practice to the cannabis industry.

HOW DOES YOUR COMPANY SUPPORT CANNABIS BUSINESSES?

AMTER: Montegra has been funding commercial real estate loans – what I call private capital bridge loans – for 50 years. Bridge loans are secured real estate loans with terms between 1 and 4 years that are designed to get the borrower from Point A to Point B. They’re not equivalent to bank or life insurance company loans because typically they have interest only payments.

Five years ago, we recognized that because banks are typically not able to fund loans to cannabis-tenant properties (since cannabis is against federal law and banks are regulated by the Federal Reserve), we set up a fund that is exclusively devoted to funding loans to cannabis-tenant warehouses or dispensaries. I wanted to call the fund the Montegra Growth Fund [audience laughed] but our legal counsel was not willing to do that – so we called it the Warehouse Fund. We are a cannabis real estate lender and lend against real property. We are making the loan to the landlord, so we’re not making business loans to cannabis growers. Sometimes, the landlord is the grower while, at other times, the landlord is just an investor and not in the cannabis business.

CRANDELL: ACM is a full-service public accounting firm. I personally lead the cannabis industry niche group. As Rachel mentioned, it was somewhat difficult in the beginning for a cannabis company or an ancillary business to find high quality legal representation. It’s still that way for CPA firms. If you are familiar with any of the “big 4” accounting firms, they currently won’t work with cannabis or cannabis-related companies here in the United States. However, ACM is able to work with the cannabis industry since we are a locally owned and operated firm. As a partner group, we recognized the need for the industry to have high-quality, high-level tax audit and consulting representation from a financialperspective.

WELLINGTON: Simplifya makes regulatory compliance software for cannabis businesses, which works on operational compliance. We work in Colorado and 10 other jurisdictions across the country for companies to provide self-auditing, not tax auditing. The software confirms if they are in compliance with cannabis regulations to which they’re subjected to, standard operating procedures, document management, licensing management and nuts-and-bolts operational compliance.

WINTER: I lead our Cannabis & Hemp practice, which touches all aspects of the cannabis industry, from seed to sale. Like any other industry, businesses in the cannabis and hemp space need to protect their property, assets, people and reputation. Our experts work with cannabis businesses and insurance carriers to get the right policies in place to protect their bottom line in new uncharted waters.

WHY IS COMPLIANCE SO IMPORTANT IN THIS INDUSTRY?

WELLINGTON: The simple answer is: if you don’t have compliance, you don’t have a business and everybody loses their job. My view is compliance is the pathway to legalization, one of the lynchpins of moving forward to the end of federal prohibition. The legalization of cannabis largely rests on the opinions of those who don’t consume it and those who could care less. About 25% of the population are really with us, 25% doesn’t favor cannabis and the other 50% could care less. Compliance is about showing that middle 50% that regulation works. The narrative in the country right now is that Colorado regulated the cannabis market and it’s working. Businesses are following the rules and public safety is being protected. As that narrative spreads around the country, people who are in that middle 50% seem to be saying, “Okay, we can give this a shot in our state since it has worked in Colorado. The businesses are following the rules, there are safety regulations and they’re not selling to children.” If compliance doesn’t occur, the narrative changes to “the cannabis companies cannot be trusted – they don’t follow the rules.” If that happens, any support from that middle 50% will begin to erode and Colorado will be looked at as an experiment that’s not working.”

TAX COMPLIANCE AND TAXES ARE A PARTICULARLY HEAVY BURDEN FOR THE CANNABIS INDUSTRY BECAUSE OF SECTION 280E OF THE TAX CODE. WHAT CAN BE DONE TO REDUCE THE COMPLIANCE RISK FOR TAXES?

CRANDELL: The IRS has been extremely active with examinations of cannabis companies since states began legalizing marijuana. If you’re the owner of a cannabis company and haven’t been audited yet, the question isn’t “if” but “when” you will be audited. It’s most likely going to happen at some point. I agree with the other panelists that 280E can really be construed as a subsidy for the black market.

I try to help my clients navigate what happens when you go through an IRS examination. If you come to me and say, “We’re under audit and need help,” and we haven’t worked together, it may be too late to take any substantial action, except to try to stop the bleeding.

The point I’m really trying to make is that you really want to be as prepared as you possibly can upfront

and have your ducks in a row. Entity structuring is key. If you have a truly non-plant-touching entity that’s a subsidiary of your enterprise, have a qualified attorney who knows the industry set that up for you. Otherwise, as we’ve seen lately, the tax courts and the IRS will attempt to collapse the entire structure and subject everything to 280E.

I would also recommend having a financial statement/ audit upfront. Have a third-party independent CPA firm come audit and review your books and records. In case of an IRS audit, having an independent financial statement audit will save a significant amount of time and, most likely, money. It starts the examination off on a good foot. Those independent financial statement audits can be an investment, but are effective and well-worth the cost.

GILLETTE: The IRS has trained investigators. I have always thought there is a wall between the IRS and my clients…and that’s me. A lot of times, they’re looking for cash controls, inventory controls because a lot of these businesses are very cash intensive. That’s why they’re auditing these businesses: they want to make sure there isn’t cash walking away and not being reported on the tax return. Documentation and good record keeping are absolutely crucial.

CRANDELL: When you go through a field examination with an IRA agent and they’re touring your facility, it’s important to showcase that as many people possible are working on the production of plants and other products. Make sure that everyone is dressed professionally and in accordance with their job function.

ARE THERE ANY GENERAL INSURANCE RISKS CANNABIS COMPANIES MAY BE OVERLOOKING?

WINTER: To piggyback from Caleb, you need to have certain things in place, like 24-hour surveillance, reinforced windows and doors. That helps articulate

the story and get the ball rolling to a favorable rating. We’re seeing companies and operators overlook vault requirements and safe requirements.

When they’re going out and retrofitting locations, insurance companies are coming out to audit. They’re taking a look and, ultimately, if you’re not in compliance with the terms in the contract, they’ll deny payment. It can be contentious. Having a good advisor will help keep you in compliance as you’re building out and looking to expand.

Research shows that non-flower related products are being sold at a higher rate than flower products. If your business is in the business of selling non-flower products, it is a good idea to see the full scope of your vendor’s insurance and where you may have gaps.

CAN YOU TELL US WHAT’S UNIQUE ABOUT UNDERWRITING AND FUNDING LOANS ON CANNABIS-TENTANTED PROPERTIES, AS WELL AS APPRAISING THOSE PROPERTIES?

AMTER: There are a number of issues obtaining good appraisals to use in underwriting cannabis warehouses. The rental rate you can get on a warehouse for your cannabis tenant can be from $15-25 dollars a square foot. Normal warehouses go for maybe $7 or $9 per square foot. The value that cannabis-tenanted building owners think their building has on a per square-foot basis sometimes rises to unrealistic heights. There are a number of Member Appraisal Institute (MAI) appraisers who won’t do appraisals for cannabis-tenanted properties. Fortunately, there are a number of MAI appraisers who will. These appraisers must arrive at a realistic value that the lender and borrower can live with. We find that many borrowers are thinking their properties are worth $350 per square foot or other unrealistically inflated values. Our appraisals look at what the building’s net operating income (NOI) is and utilize a higher cap rate than is applied to non-cannabis tenanted properties. They are not easy appraisals to do.

FORMER GOV. JOHN HICKENLOOPER VETOED BILLS LAST YEAR THAT AFFECTED CANNABIS BUSINESSES. WHAT SHOULD WE EXPECT THIS YEAR SINCE VOTERS ELECTED A NEW GOVERNOR, JARED POLIS, WHO IS CANNABIS-FRIENDLY?

WELLINGTON: This is likely to be the most important session for cannabis since 2013 in Colorado. The bill approving medical cannabis for autism has passed two of six votes. Another bill would allow doctors to recommend cannabis as an alternative to opioids. We’re really trying to drive through a lot of reforms on how the financial governance and ownership of cannabis businesses is being checked, not just from a publicly-traded company’s perspective. Those changes could open up a lot of investment in Colorado.

There are two other pieces of legislation that are near and dear to my heart, which are the delivery legislation and the social use legislation. Cannabis is the only commodity I consume that I have to leave my house to acquire. We’re trying to turn that paradigm on its head a little bit, where you can get it delivered like other commodities and then go out into social environments and use it. Right now, using anything outside your house is pretty much illegal.

WHAT SHOULD CANNABIS BUSINESS OWNERS KNOW ABOUT THE RECENT TAX-COURT CASES?

CRANDELL: Tax reform has been on everyone’s mind the past year. Cannabis-related companies were mostly overlooked in terms of the general tax provision changes. However, there are several provisions that could potentially be very beneficial. They’re mostly centered around entity structuring. One of the new provisions is called the Section 199-A deduction, also known as the Qualified Business Income Deduction. Congress didn’t explain how the

deduction correlates to 280E, so it’s a total gray area in my mind at this point as to whether or not you can claim the deduction. That’s going to be a decision made by cannabis owners along with their trusted advisors to determine if that deduction qualifies.

I’m positive many cannabis companies will attempt to claim that deduction. From there, the IRS and tax courts ultimately will have to figure it out.

GILLETTE: We haven’t had many favorable decisions from the tax court on the cannabis side.

WE ALL KNOW THE MOST SUCCESSFUL BUSINESSES REQUIRE THE BRIGHTEST AND BEST TALENT. WHAT CAN THE CITY AND STATE DO TO RETAIN TOP-QUALITY JOBS AND ATTRACT TOP TALENT?

WINTER: Inherently, this will come off as a business discussion. It’s all about what is your human capital strategy? What are you doing to attract and retain employees? How do you want to deploy that capital in a way that’s most meaningful to you and the people working with you? We’re seeing the explosion of cannabis businesses across the United States. There’s a war on talent as new groups open in other states and employers compete to retain and attract top talent. Secondly, we’re evolving into a gig economy – you don’t see an exclusive employer-employee relationship anymore. The employees may have other opportunities for benefits and related items. That means it’s not as simple as offering medical, dental and vision benefits. It may be how you’re going to improve the experience for the employee in the operation because you want to keep them there.

With Gov. Polis and our current administration, we have fantastic support and I think there will be more opportunities within that space. Ultimately, down the road, I think there’s the possibility for some sort of

[cannabis] association for a health plan – where all the businesses can come together and drive down the cost of medical, dental and vision benefit offerings. There’s also talks of ways to reduce pharmacy costs, which are 20 to 30 percent of an employee-benefit spend right now. Those are meaningful dollars. You want to improve an employee’s experience so you can keep them around.

WELLINGTON: I would like to note that – on the employees and talent front – we’re still far ahead of the game. This is where the experiences are. This is where the talent and operating industry are. The problem is the opposite – attracting new businesses and entrepreneurship in the cannabis space. There are some very large cannabis businesses who are trying to determine where their headquarters will be located. Many of them are looking at Los Angeles, New York, San Francisco and Denver. We all know there is one reason why, truthfully, Denver is on the list. It’s because we regulated our cannabis businesses years before those other states. We have the talent and the jump-start here but are we doing things to attract businesses?

We need to protect public health and safety but we also need to encourage research an investment into the cannabis space in Colorado. This is Colorado’s opportunity to be a leader in the cannabis space to be a hub for this industry and to do everything we can, from engaging with the Economic Development Office, our tourism office and our regulatory agencies to make sure there are not just $12-15 an hour front-line jobs in Colorado in 15 years. Are there other six-figure or executive jobs? We need to make sure there are avenues in our state to get there to that point.

COULD YOU TALK A LITTLE MORE ABOUT THE INSURANCE MARKET FOR CANNABIS?

WINTER: It depends on how you’re operating your business. If you’re operating in the cannabis industry as an ancillary business, there’s a high probability you can have placement with an admitted carrier. Predominantly, most coverage is through the excess and lines marketplace but there are limitations. There are more than 20 providers who make sense for cannabis owners to work with and that have an appetite to work with cannabis businesses. Other markets are entertaining different lines of coverages and options all the time. It’s rapidly evolving and a continual process to bring the markets up to speed on what the risk profile looks like. We’re seeing new markets entering and exiting the space and better opportunities monthly.

FIVE YEARS FROM NOW, WILL THERE BE WINNERS AND LOSERS IN THE CANNABIS INDUSTRY?

GILLETTE: There will definitely be winners and losers. I hope in 5 years we will have federal legalization. We’ve just seen a huge change with industrial hemp. Prior to the passage of the farm bill recently, hemp was a Schedule 1 controlled substance. That was huge – really, really big.

While we still have the things to work out with the FDA and the USDA, that industry is just poised for tremendous growth. Five years from now, I’m hoping we’re back here talking about the nuances of the federal legalization bill, so we can work to refine and perfect them.

Sooner or later, I’d still like to see expanded banking regulations because this business is under-banked. There’s no reason why these businesses should have to operate all in cash. It’s ridiculous and not in anybody’s best interest. I’d also like to see them get rid of 280E, a section of the tax code that is unnecessarily prohibitive to legally operating cannabis-related businesses.

The presenting sponsors for the “Business of Cannabis” event at ART Hotel were Greenspoon Marder and Lockton. Gold Sponsors were ACM and Montegra Capital Resources. Denver Business Journal Editor-in-Chief Rebecca Troyer introduced the event, which also included a panel discussion on Colorado’s role in the global cannabis market.

-Edited by Don Ireland